Introduction

The world of finance is interconnected, much like a web. The strands of this web represent different elements like personal finance, global economics, national economy, and other financial sectors. While it might seem that personal finance is a separate entity, it's significantly influenced by the global economy. This article will explore how global economics impacts personal finance and how understanding these influences can help individuals make better financial decisions.

How Global Economics Influences Personal Finance

Global economics encompasses the economic activities of various countries and how they interrelate. These activities impact personal finance in several ways

1. Inflation and Purchasing Power

Inflation, a concept where the general level of prices for goods and services rises, is a significant factor in global economics. It causes the value of money to decrease, impacting the purchasing power of an individual. A higher inflation rate in your country compared to others can decrease your relative purchasing power on an international scale.

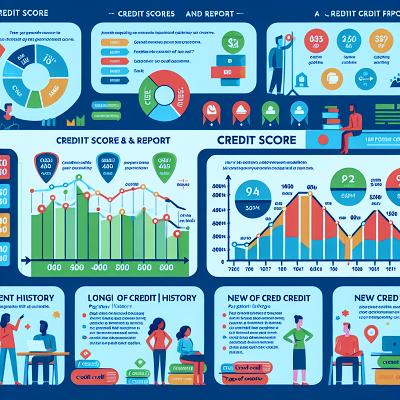

2. Interest Rates

Central banks around the world adjust interest rates to control inflation and stabilize their country's economy. These interest rates directly impact the rates set by commercial banks for savings, loans, and mortgages. Consequently, global economic conditions that influence these rates will affect your personal finance decisions, especially concerning borrowing and saving.

3. Exchange Rates

The global economy determines the exchange rates between different currencies. If your home currency weakens against others, your purchasing power decreases globally. This situation impacts individuals who travel frequently, those who invest in foreign stocks, or businesses that import goods.

4. Employment and Income

Global economic conditions can influence employment rates and income levels. For instance, a global recession can lead to increased unemployment rates, wage freezes or cuts, which directly impact personal finances.

5. Investment Opportunities

The global economic climate influences the performance of various investment markets. A thriving global economy often means a bullish stock market, presenting lucrative investment opportunities. Conversely, a global economic downturn can make certain investment markets volatile and risky.

Understanding Global Economics for Better Personal Finance Management

Understanding global economics can equip individuals with the knowledge to navigate their personal finances effectively in the context of a global economic landscape.

1. Diversification

Knowing the impact of global economics can help individuals diversify their investment portfolio. For instance, if certain economies are projected to grow, investing in stocks or mutual funds based in those countries could yield higher returns.

2. Informed Decision-Making

Awareness of global economic conditions can guide personal financial decisions. For example, understanding how interest rates are impacted can help one decide whether it's a good time to take out a loan or to focus on saving.

3. Financial Planning

By keeping an eye on the global economic trends, one can adjust their financial plans accordingly. For instance, during a global recession, it may be wise to cut back on discretionary spending and focus more on building an emergency fund.

Conclusion

The global economy and personal finance are intricately linked. While it's impossible to control the global economic conditions, understanding their impact can empower individuals to make informed financial decisions. By staying informed about global economic trends, individuals can better manage their personal finances and ensure their financial health, regardless of the economic climate.