Introduction

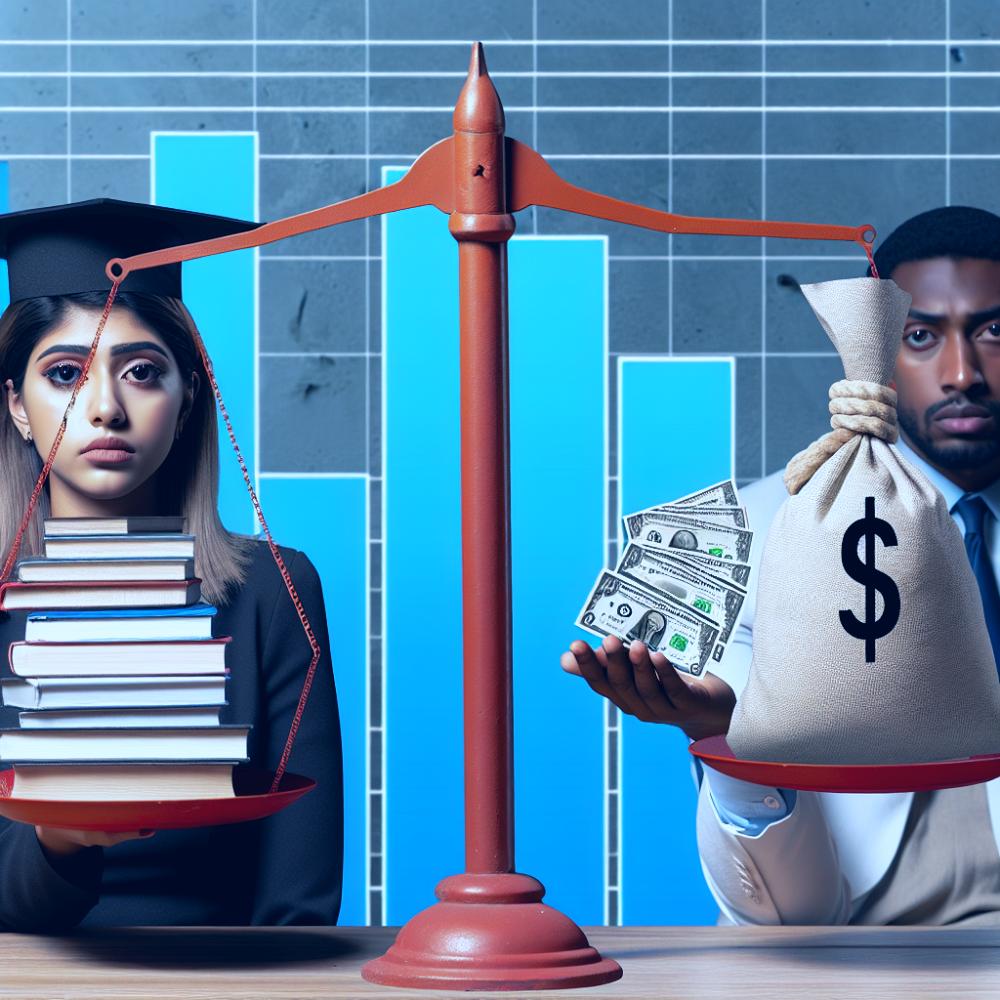

In the pursuit of higher education, many students find themselves tangled in the web of student loans. These loans, considered by many as a necessary evil, provide the financial means to get through years of schooling. However, the impact of student loans on the long-term financial health of the borrower is profound and far-reaching.

The Burden of Student Loans

According to a report by the Federal Reserve Bank of New York, the total student loan debt in the United States is a staggering 1.58 trillion dollars, surpassing credit card and auto loan debt. This debt load is shared by approximately 44.2 million Americans, and the average monthly student loan payment (for borrowers aged 20 to 30 years) is around $393.

The burden of repaying student loans can delay or even derail important life milestones such as buying a house, starting a family, or saving for retirement. The pressure of repayment can also lead to mental health issues and cause undue stress, affecting the overall quality of life.

Impact on Credit Score

Student loans, like any other type of loan, can impact your credit score. On-time payments can boost your credit score, but late or missed payments can significantly lower it. A lower credit score can make it harder to get approved for credit cards, car loans, or mortgages, and if you do get approved, you'll likely pay higher interest rates.

Moreover, student loans can increase your debt-to-income ratio, which is another factor lenders consider when determining your creditworthiness. A high debt-to-income ratio can further limit your ability to obtain new credit.

Implications for Home Ownership

The dream of owning a home can be elusive for those burdened with student loan debt. As per the National Association of Realtors, about 83% of non-homeowners cite student loan debt as the factor delaying them from buying a home. This delay in home ownership also means a delay in building home equity, which is often a significant part of an individual's wealth.

Impact on Retirement Savings

Student loan debt can also impede your ability to save for retirement. With a significant portion of income going towards loan repayments, there is often little left to contribute to retirement savings. According to a study by the Center for Retirement Research, those with student debt accumulate 50% less retirement wealth by age 30 than those without.

Dealing with Student Loan Debt

Despite the burden, there are strategies to manage student loan debt effectively

Understand Your Loans

It's crucial to understand the terms of your loans, including the interest rate, repayment schedule, and options for forbearance or deferment.

Make a Budget

A well-planned budget can help ensure that you're making your loan payments on time and not accruing more debt.

Consider Refinancing

If you have high-interest student loans, refinancing them at a lower interest rate can save you a significant amount of money over the life of the loan.

Explore Forgiveness Programs

Some professions, like teaching or public service, offer student loan forgiveness programs.

Start Saving Early

Even if it's a small amount, start saving for retirement as early as possible to take advantage of compound interest.

Conclusion

While student loans may be a necessary means to an end, their impact on financial health is undeniable. They can affect your credit score, limit your ability to buy a home, and impede your retirement savings. However, with proper management and planning, it's possible to navigate the challenges of student loan debt and set yourself up for a secure financial future.