Introduction

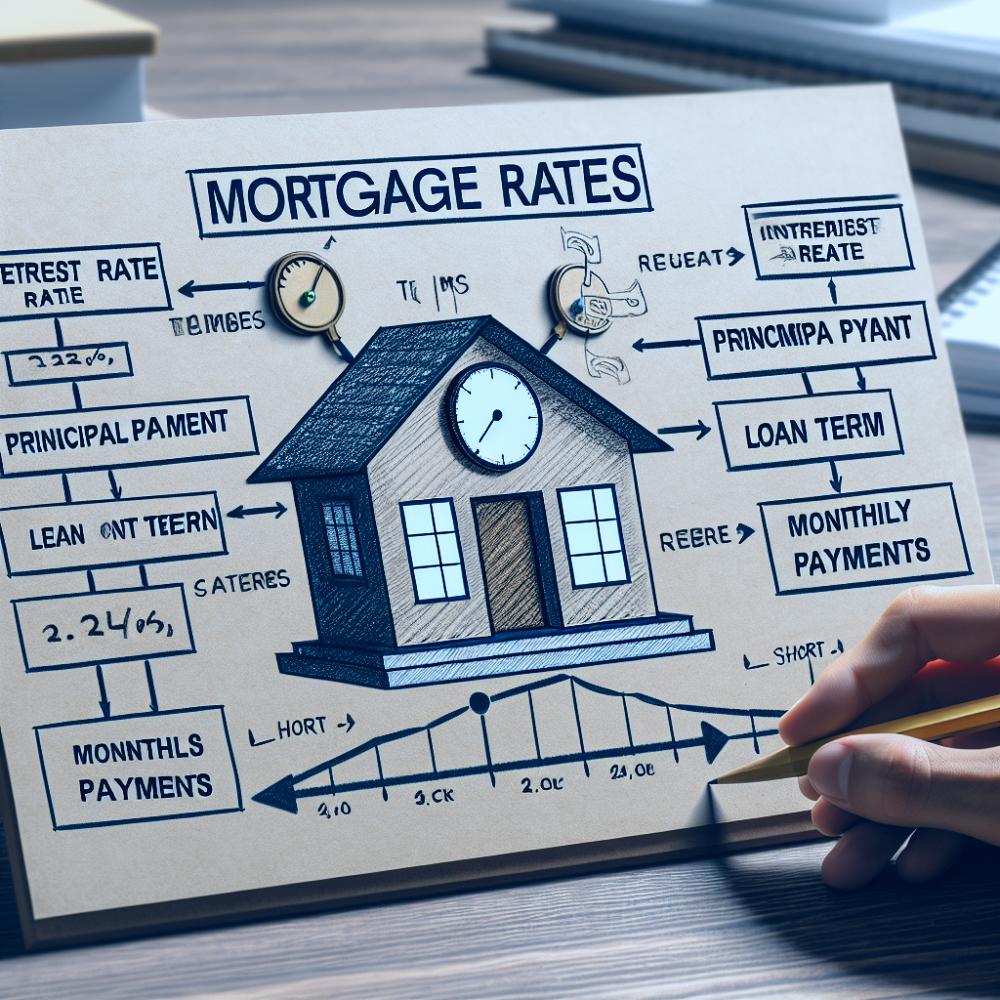

When it comes to purchasing a home, one of the most critical aspects to understand is the mortgage process. Mortgage rates and terms can be complex, with various factors contributing to the final figures. This article aims to clarify these elements, providing a comprehensive guide to understanding mortgage rates and terms.

What is a Mortgage Rate?

A mortgage rate is the interest charged on a loan used to purchase or refinance a home. It is typically expressed as an annual percentage of the loan balance. Mortgage rates can either be fixed or variable. A fixed-rate mortgage means the interest rate remains the same throughout the loan term, while a variable-rate mortgage means the interest rate can change over time based on market conditions.

Key Factors Influencing Mortgage Rates

Several factors can influence the mortgage rate a borrower is offered

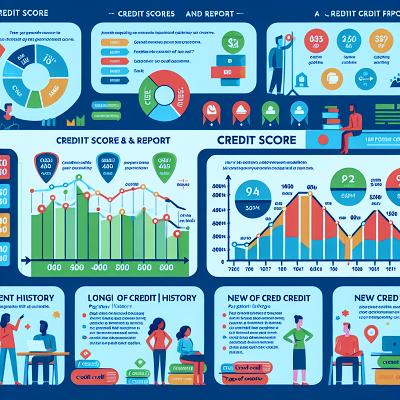

Credit Score

Generally, the higher your credit score, the lower your mortgage rate. This is because lenders consider borrowers with higher credit scores to be less risky.

Down Payment

Putting down a larger down payment can lead to a lower mortgage rate as it reduces the lender's risk.

Loan Type

The type of mortgage loan can also affect your rate. For example, 15-year fixed-rate loans typically have lower rates than 30-year fixed-rate loans.

Market Conditions

Economic factors such as inflation, economic growth indicators, and Federal Reserve policies can influence mortgage rates.

Understanding Mortgage Terms

Along with the mortgage rate, it is essential to understand the terms of your mortgage. Here are a few key terms

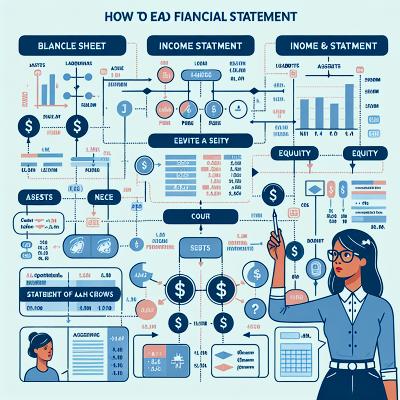

Principal

This is the amount of money you borrow to buy your home. Over time, you will repay the principal plus interest.

Interest

This is the cost of borrowing money. It is calculated as a percentage of your outstanding loan balance.

Term

The term is the length of time you have to repay the loan. Common terms are 15, 20, and 30 years.

Amortization

This is the process of paying off debt over time through regular payments. An amortization schedule is a table showing each payment amount, how much goes toward principal and interest, and the remaining loan balance after each payment.

Escrow

This is an account set up by your lender to pay certain property-related expenses on your behalf like property taxes and homeowners insurance.

Choosing the Right Mortgage for You

Choosing the right mortgage requires considering your financial situation, long-term plans, and risk tolerance. If you plan to stay in your home for a long time and prefer stability, a fixed-rate mortgage may be the best choice. On the other hand, if you plan to move in a few years or are confident you can handle potential rate increases, a variable-rate mortgage may be more cost-effective.

Conclusion

Understanding mortgage rates and terms is key to making informed decisions about your home purchase. Ensure to consider all factors, including your credit score, down payment, and loan type, when determining what mortgage rate and terms are best for you. Always remember that a knowledgeable homeowner is an empowered homeowner.