Introduction

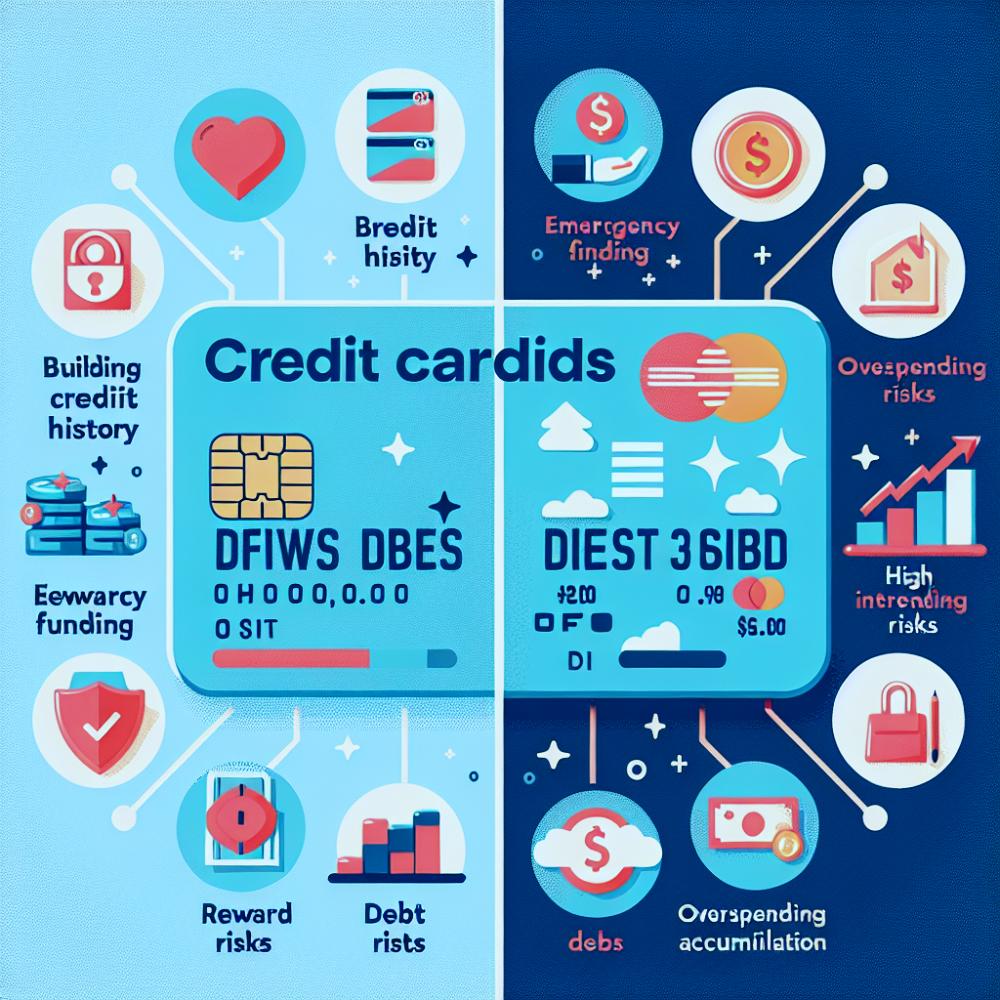

Every monetary decision comes with its benefits and drawbacks, and credit cards are no exception. A staple in today's financial landscape, credit cards offer a plethora of advantages, from convenience to rewards programs. However, they also carry potential pitfalls, such as interest charges and the risk of debt. This article aims to provide an in-depth analysis of the pros and cons of credit cards to help you make an informed decision.

The Pros of Credit Cards

Convenience

One of the most significant benefits of credit cards is convenience. They save you from carrying large sums of cash and are accepted worldwide. This makes them handy for emergencies or big purchases and invaluable for travel, particularly in foreign countries.

Building Credit

Responsible use of a credit card can help build your credit score, which is essential for getting loans, renting an apartment, or even landing some jobs. Regularly paying off your card balance demonstrates to lenders that you can manage your debts effectively.

Rewards and Cash Back

Many credit cards offer enticing rewards programs, such as air miles, hotel points, or cash back on purchases. If you pay off your balance in full each month, these rewards can add up to significant savings over time.

Protection Against Fraud

Credit cards come with robust security features and fraud protection. If your card is lost or stolen, you're typically not responsible for unauthorized charges. Plus, many card issuers provide alerts for suspicious activity, offering an extra layer of security.

The Cons of Credit Cards

Interest and Fees

Undoubtedly, one of the most significant drawbacks of credit cards is the potential for high interest and fees. If you don't pay off your balance in full each month, you'll be charged interest on the remaining amount. Over time, this can lead to considerable debt. Additionally, credit cards often come with various fees, including annual fees, late payment fees, and cash advance fees.

Potential for Debt

Credit cards can lead to a cycle of debt if not used responsibly. It's easy to spend more than you can afford, especially with high credit limits. Over time, this can lead to significant debt that can be difficult to pay off, impacting your financial health and credit score.

Credit Score Damages

While responsible use can boost your credit score, irresponsible use can harm it. Late or missed payments will negatively impact your score. Additionally, using a high percentage of your available credit can also lower your score, even if you pay your bills on time.

Encourages Impulsive Spending

The convenience and easy access to credit can encourage impulsive spending. You might be tempted to make unnecessary purchases just because you can or to take advantage of rewards offers. This can lead to overspending and subsequent debt.

Conclusion

Credit cards can be a powerful financial tool if used responsibly. They offer convenience, the ability to build credit, rewards, and fraud protection. However, they also come with pitfalls like high interest, potential for debt, credit score damage, and the temptation to overspend. Understanding these pros and cons can help you make informed decisions about whether a credit card is right for you and how to use it wisely.