Introduction

Planning for a financially secure retirement is more critical now than ever before. With increasing life spans, rising health care costs, and the uncertain future of social security, retirement planning requires careful thought and detailed strategy. Here, we will discuss the key steps to ensure that you have enough money to enjoy a comfortable lifestyle after you stop working.

Start Early

The earlier you start saving, the more time your money has to grow. If you start in your 20s, you can save less money each month than if you start in your 40s or 50s and still end up with the same amount. Thanks to the power of compound interest, your savings will grow exponentially over time. So, starting early will give you a significant advantage.

Set Clear Goals

It's crucial to have a clear idea of what you want your retirement to look like. Do you want to travel extensively? Do you plan to move to a warmer climate? Or do you simply want to spend time with your grandchildren? Once you have a vision, you can estimate how much money you'll need to make it a reality.

Maximize Your Contributions

If your employer offers a retirement savings plan, like a 401(k), make sure you’re contributing as much as possible. The contributions you make to your plan are typically tax-deductible, and the growth in your account is tax-deferred. If your employer matches contributions, that's free money - don't leave it on the table.

Create a Diversified Portfolio

Investing in a diversified portfolio is one of the most effective ways to grow your retirement savings. A mix of stocks, bonds, and other investments can help reduce risk and increase potential returns. Your exact mix will depend on your age, risk tolerance, and retirement goals.

Consider a Roth IRA

A Roth IRA is another excellent tool for retirement savings. While you won't get a tax break for contributions, the money you withdraw in retirement is tax-free. This can be a significant advantage, especially if you anticipate being in a higher tax bracket in retirement.

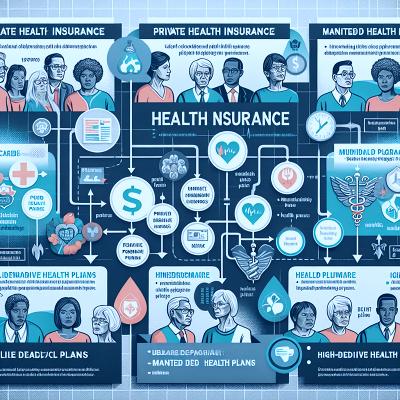

Plan for Healthcare Costs

Healthcare is often one of the most significant expenses in retirement. Consider investing in a Health Savings Account (HSA) if you're eligible. The money you contribute is tax-deductible, and the withdrawals are tax-free if used for qualified medical expenses.

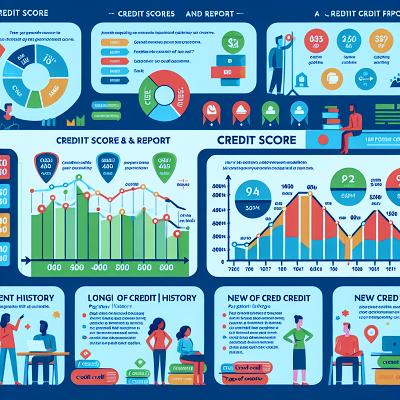

Reduce Debt

Entering retirement with high levels of debt can put a serious dent in your retirement savings. Make a plan to pay off your debt as much as possible before retiring. This includes your mortgage, car loans, and credit card debt.

Create a Retirement Budget

A detailed retirement budget can help you understand how much you'll need to maintain your lifestyle. Be sure to factor in all sources of income, including social security, pensions, and retirement account withdrawals. Don't forget to account for inflation, which can significantly impact your purchasing power over time.

Work with a Financial Advisor

A professional financial advisor can provide personalized advice based on your individual circumstances and goals. They can help you create a comprehensive retirement plan, choose suitable investments, and adjust your strategy as needed over time.

Conclusion

Planning for a financially secure retirement may seem daunting, but it's never too late to start. By saving early and often, investing wisely, and planning for healthcare and other expenses, you can build a comfortable nest egg for your golden years. Remember, the goal isn't just to retire, but to retire comfortably and securely, living the lifestyle you envision for yourself.