Introduction

Whether you're a first-time homebuyer or an experienced homeowner looking to refinance, negotiating a mortgage can be a daunting task. The terms of your mortgage could make a significant difference in your overall financial future. However, with the right strategy, you can negotiate better mortgage terms and save thousands of dollars over the life of your loan. Here's a comprehensive guide on how to negotiate better mortgage terms.

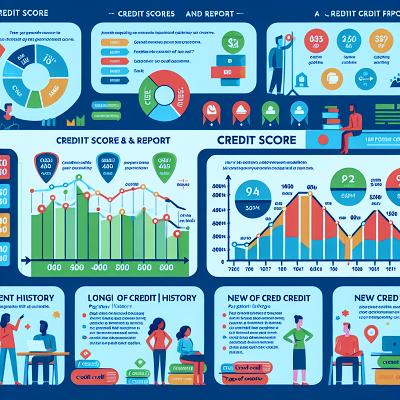

Understand Your Credit Score

Before you even approach a lender, it's crucial to understand your credit score. This three-digit number is a key factor in determining the interest rate you'll be offered. The higher your credit score, the lower your interest rate, potentially saving you thousands of dollars over the life of your mortgage. Therefore, review your credit report and correct any errors before starting the negotiation process.

Shop Around

Different lenders have different criteria for their loans, and it's possible that you could get a better deal elsewhere. Therefore, it's essential to shop around and gather quotes from multiple lenders. This will give you a better understanding of what the current mortgage market looks like and help you identify the best possible deal.

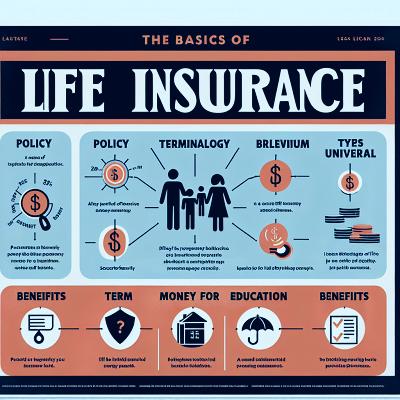

Negotiate Interest Rates

Interest rates are one of the most critical factors of a mortgage. Even a slight difference in your interest rate could result in substantial savings over the life of the loan. While rates are largely determined by market conditions and your credit score, there is still room for negotiation. Don't be afraid to ask for a lower rate, especially if you have a stellar credit score or a sizeable down payment.

Ask for Lower Fees

Interest rates aren't the only cost associated with a mortgage. There are also various fees, such as origination fees, application fees, and appraisal fees. Some of these fees are negotiable. Don't hesitate to ask your lender to waive or reduce these fees. Remember, every dollar saved is a dollar you can put towards your new home.

Be Ready to Walk Away

One of the most powerful negotiation strategies is showing that you're not afraid to walk away if you can't get the terms you want. If a lender knows that you're shopping around and are willing to take your business elsewhere, they may be more willing to negotiate.

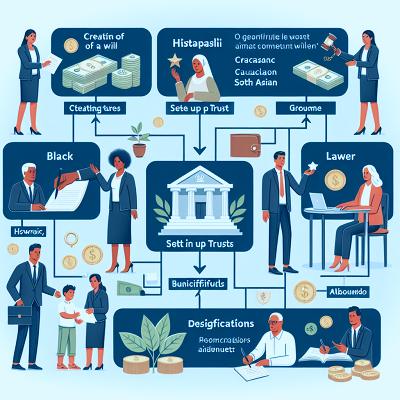

Consider a Mortgage Broker

A mortgage broker can be a valuable ally in the negotiation process. They have extensive knowledge of the mortgage market and can help you find the best deal. Moreover, they can handle the negotiation process on your behalf. While hiring a broker can come with its own costs, the potential savings could outweigh those expenses.

Conclusion

Negotiating better mortgage terms can be a complex process, but it's well worth the effort. By understanding your credit score, shopping around, negotiating interest rates and fees, and being ready to walk away, you can secure a mortgage that fits your financial situation. Remember, every bit of effort you put into negotiating your mortgage could save you a significant amount of money in the long run.