Introduction

Understanding credit scores and reports is a vital aspect of financial literacy. These critical numbers and documents reflect your creditworthiness, impacting significant life events like buying a home, starting a business, or even getting a job. This article will explore what credit scores and reports are, how they're calculated, and how to improve your credit profile.

What is a Credit Score?

A credit score is a three-digit number derived from your credit history. It represents the likelihood that you will pay your debts on time. Lenders use credit scores to assess the risk involved in lending money, offering credit, or providing a service.

There are several types of credit scores, but the most widely used are FICO Scores and VantageScore. These scores range from 300 to 850, with higher scores indicating lower credit risk.

What is a Credit Report?

A credit report is a detailed record of your credit history, prepared by a credit bureau. It includes information such as

- The number and types of credit accounts you have (credit cards, mortgages, car loans, etc.)

- How long each of your credit accounts has been open

- Whether you’ve paid your bills on time

- How much of your available credit you are currently using

- Whether you have any collection actions against you

- Any public record information (bankruptcies, tax liens, etc.)

The three major credit bureaus in the United States—Experian, Equifax, and TransUnion—collect this information from lenders, creditors, and other sources, then sell it to businesses that have a permissible purpose to use it.

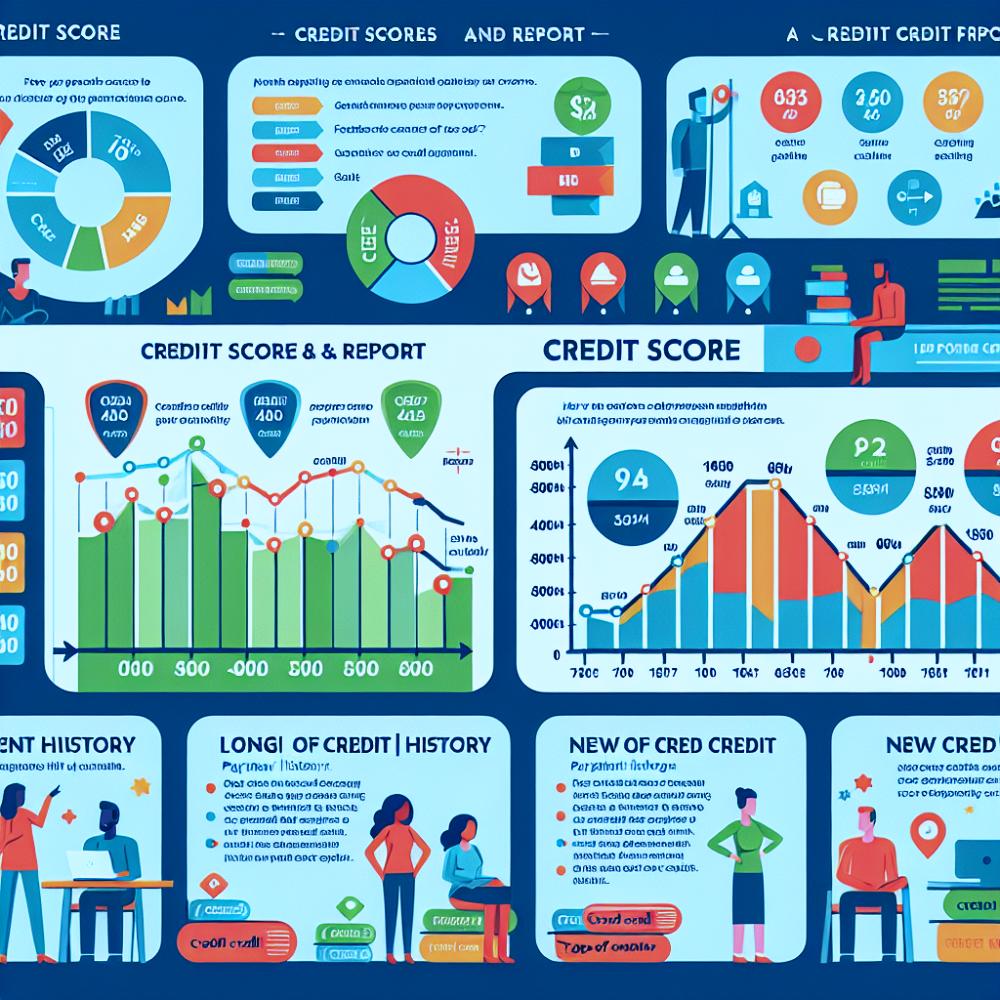

How are Credit Scores Calculated?

Credit scores are calculated using a variety of factors, including payment history, credit utilization, length of credit history, new credit, and credit mix.

Payment history (35% of the FICO Score) refers to whether you've paid past credit accounts on time. Credit utilization (30%) is the percentage of your available credit that you're currently using. Length of credit history (15%) looks at how long your credit accounts have been open. New credit (10%) factors in how many new credit accounts you've recently opened, and credit mix (10%) considers the different types of credit you're using.

How to Improve Your Credit Score

Improving your credit score is not a quick process, but there are steps you can take to start boosting it

Pay Your Bills on Time

Since payment history is a significant factor in your credit score, it's crucial to always pay your bills on time. Even a few late payments can significantly damage your score.

Decrease Your Credit Utilization

Try to keep your credit utilization below 30%. This means if you have a credit limit of $10,000, you should try to keep your balance below $3,000.

Don't Close Old Credit Cards

The length of your credit history matters. If you're not using a credit card, instead of closing it, put it in a drawer and forget about it.

Limit Credit Enquiries

When you apply for credit, it results in a hard inquiry on your credit report, which can lower your score. Only apply for credit you need.

Maintain a Mix of Credit

Having a mix of credit types—credit cards, car loan, mortgage—can positively impact your score.

Conclusion

Understanding your credit score and report is a fundamental aspect of managing your finances. By keeping a close eye on your credit report and making positive financial decisions, you can maintain a good credit score, which can pave the way for better financial opportunities in the future.