Introduction

Life is a journey characterized by various major events - from education to career development, marriage, buying a home, starting a family, retirement, and more. These events can significantly impact your financial situation. Therefore, it is crucial to plan effectively to ensure you can handle these life milestones without straining your finances. This article will offer essential tips on planning for major life events to help you navigate your financial journey effectively.

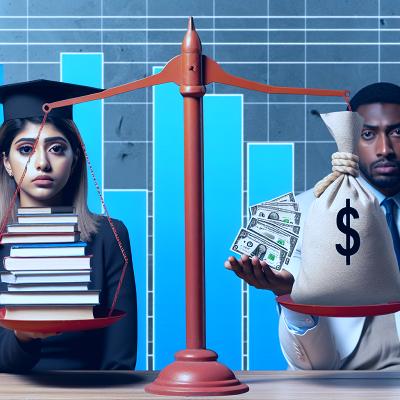

Education

Education is a significant investment that can shape your future career and income. However, it can also represent a substantial financial burden. Planning for education costs involves saving early and exploring various funding options like scholarships, grants, and student loans. Implementing a 529 plan or an education savings account can be a practical way to save for future education expenses.

Starting a Career

Starting a career is an exciting chapter in life. It's the time to start saving for your future and planning for financial independence. Maximizing your income during these years is crucial. Consider diversifying your income streams and investing wisely. Additionally, ensure you build an emergency fund that can cover at least three to six months of living expenses.

Marriage

Marriage is a significant life event that combines not just two lives, but also two financial situations. It's important to communicate openly about finances, understand each other's financial goals, and work together to create a joint budget. Consider seeking professional financial advice to help merge your finances and plan for your future together.

Buying a Home

Purchasing a home is one of the biggest financial commitments you will make. It's essential to save for a down payment, shop around for the best mortgage rates, and consider the ongoing costs of homeownership, including taxes, insurance, and maintenance. You should also consider your long-term plans, as buying a home is generally a long-term investment.

Starting a Family

Starting a family is a joyous event, but it also comes with significant financial responsibilities. It's important to plan for the costs associated with raising a child, including healthcare, education, and daily living expenses. Consider starting a college savings plan for your child early on and ensure you have adequate life and health insurance to protect your family.

Retirement

Retirement planning should start as early as possible to ensure you have enough funds to maintain your desired lifestyle. Start contributing to your retirement plan as early as you can, maximize your employer's matching contributions if available, and invest wisely. It's also important to consider the potential costs of healthcare in retirement and explore options such as long-term care insurance.

Conclusion

Planning for major life events can feel overwhelming, but with careful planning and smart financial strategies, you can navigate these milestones with ease. Remember, the key to financial success is being proactive rather than reactive. Start planning today to secure your financial future and enjoy the peace of mind that comes with being financially prepared. Seek professional financial advice if needed to help guide you through this journey.