Introduction

Wealth accumulation is a long-term process that requires strategic planning, discipline, and smart financial decisions. It's not just about earning more, but also about saving, investing, and growing your money over time. In this article, we will explore various strategies for wealth accumulation that can help you achieve your financial goals.

Strategy 1

Start Saving Early

One of the most crucial steps to wealth accumulation is starting to save as early as possible. Thanks to the power of compounding, the earlier you start saving, the more your wealth can grow over time. Set aside a portion of your income every month for savings. This money should be separate from your emergency fund and should be used for long-term goals, such as retirement.

Strategy 2

Develop Multiple Streams of Income

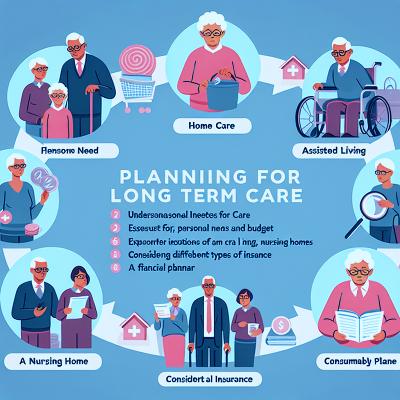

Relying on a single source of income can be risky. To accumulate wealth, consider developing multiple streams of income. This could include part-time jobs, freelance work, investment income, rental income, or starting a side business. Having multiple income streams not only provides financial security but also accelerates your wealth accumulation process.

Strategy 3

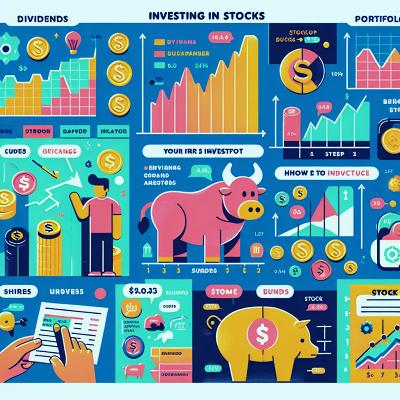

Invest Wisely

Investing is an essential part of wealth accumulation. It allows your money to work for you and generate more money over time. Diversifying your investments across various asset classes such as stocks, bonds, real estate, and mutual funds can spread risk and increase potential returns. Remember that investing involves risks and it's important to do your research or consult with a financial advisor before making investment decisions.

Strategy 4

Live Below Your Means

Living below your means implies spending less than what you earn. It's a crucial strategy for wealth accumulation as it allows you to save and invest more. This doesn’t mean you have to deprive yourself of everything you enjoy, but rather making smart spending decisions, avoiding unnecessary expenses, and focusing on long-term financial goals.

Strategy 5

Regularly Review and Adjust Your Financial Plan

Wealth accumulation is not a set-it-and-forget-it process. It requires regular review and adjustments to your financial plan. Factors like changes in income, market conditions, personal circumstances, and financial goals can necessitate adjustments in your wealth accumulation strategy. Regular reviews can help you stay on track and make necessary changes to optimize your wealth accumulation.

Strategy 6

Minimize Debt

Debt can be a significant obstacle to wealth accumulation. High-interest debt, such as credit card debt, can drain your resources and hinder your ability to save and invest. Focus on paying off your debts as quickly as possible. Once you're debt-free, you can redirect that money towards your savings and investments.

Strategy 7

Continually Educate Yourself

Financial education is key to wealth accumulation. The more you understand about finances, the better decisions you can make. Continually educate yourself about personal finance, investing, taxes, and other related topics. This can help you make informed decisions that can accelerate your wealth accumulation process.

Conclusion

Wealth accumulation is a journey, not a destination. It requires patience, discipline, and persistence. By implementing the strategies discussed above, you can effectively accumulate wealth over time and achieve your financial goals. Remember that everyone's financial situation is unique, so it's important to customize these strategies to suit your specific needs and circumstances. It's never too late to start your wealth accumulation journey. Start today, and pave the way for a secure financial future.