Introduction

In our fast-paced world, the concept of earning money while you sleep has never been more appealing. Passive income, a stream of income that requires little to no effort to maintain, can provide financial stability and freedom. Building passive income streams can be your ticket to early retirement or just a more relaxed lifestyle. This article delves into the strategy of creating passive income streams and how to make them work for you.

Understanding Passive Income

Passive income is earnings derived from a rental property, limited partnership, or other enterprise in which a person is not actively involved. It's money that you earn without having to trade your time. However, don't be misled by the word "passive". Setting up a passive income stream requires upfront work, investment, or both. It's about putting in the effort now to reap benefits later.

How to Build Passive Income Streams

There are several effective ways to generate passive income, each with its own set of pros and cons. Here are some methods to consider

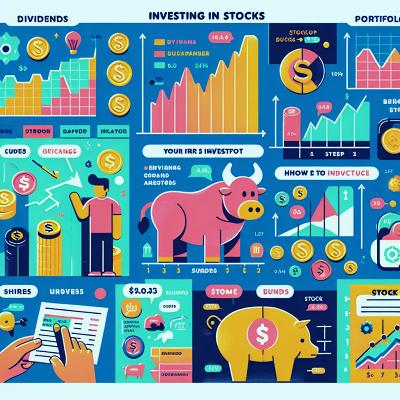

1. Investing in Stocks and Bonds

Investing in the stock market can be a lucrative way to create a passive income stream. By purchasing stocks, you own a piece of a company and will receive a portion of their profits in the form of dividends. Bonds, on the other hand, are basically loans you give to companies or the government. They pay you back with interest over a specific time period.

2. Real Estate Investments

Real estate can be a profitable passive income source. You can rent out properties and earn a steady income. Alternatively, you can invest in Real Estate Investment Trusts (REITs), which allows you to invest in real estate without the physical property's obligations and responsibilities.

3. Peer-to-Peer Lending

Platforms like LendingClub, Prosper, and others allow you to lend money to individuals or small businesses in return for a hefty interest rate. It's a win-win situation

borrowers get funds without having to go through a bank, and lenders can earn higher returns than traditional savings or investment methods.

4. Creating a Blog or YouTube Channel

If you have a knack for creating engaging content, consider starting a blog or YouTube channel. While these take considerable effort to start, with time and consistent high-quality content, you can earn a significant income through advertising, sponsorships, and affiliate marketing.

5. Affiliate Marketing

With affiliate marketing, you promote a product or service on your website or social media platform and earn a commission for every purchase made through your referral link. It's a great way to earn passive income if you have a strong online presence.

6. Creating an Online Course or E-Book

If you're an expert in a particular field, why not create an online course or write an e-book? Platforms like Udemy, Coursera, or Amazon Kindle Direct Publishing make it easy to share your knowledge and earn a passive income.

7. Renting Out Your Car or Spare Room

Platforms like Airbnb, Turo, or HyreCar allow you to rent out your spare room, entire home, or even your car. It's an easy way to monetize assets you're not using all the time.

Conclusion

Building passive income streams is a strategic move towards financial independence. Although it requires effort, diligence, and sometimes an initial investment, the financial freedom it offers makes it worth it. By exploring the options listed above, you can find the best passive income stream that aligns with your skills, interests, and financial goals. Remember, the journey to passive income is a marathon, not a sprint. With patience and persistence, you can build a financial future that allows you to live on your own terms.