Introduction

Financial wellbeing is an integral part of our lives that affects almost every aspect of our daily activities. Despite its significance, the complexity of financial management often results in poor money decisions leading to financial stress. This is where financial coaching and counseling comes in to provide solutions.

What is Financial Coaching and Counseling?

Financial coaching and counseling are personalized services aimed at equipping individuals with the necessary skills to make sound financial decisions. While both are geared towards improving financial health, they differ slightly in their approach.

Financial coaching is a process that helps individuals define their financial goals, develop a plan to achieve them, and provide support along the journey. It is future-oriented, focusing on building financial skills and behaviors for long-term success.

On the other hand, financial counseling is generally short-term and often geared towards solving specific financial problems like debt management, budgeting, or bankruptcy. Financial counselors analyze your current financial situation, provide advice, and may liaise with creditors on your behalf.

The Benefits of Financial Coaching and Counseling

Improved Financial Literacy

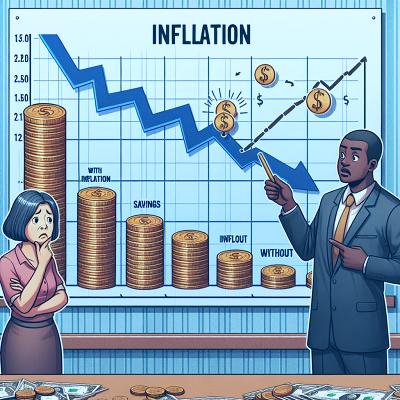

One of the most substantial benefits of financial coaching and counseling is enhanced financial literacy. These services help you understand complex financial concepts and terms, enabling you to make informed decisions about your money. With improved knowledge, you're less likely to fall into financial traps or make poor investment choices.

Goal Setting and Achievement

Financial coaches help clients set realistic financial goals and work towards achieving them. Whether it's saving for a home, planning for retirement, or reducing debt, a financial coach will guide you through the steps you need to take to reach your goals.

Debt Management

Debt can be overwhelming, and without proper management, it can spiral out of control. Financial counselors are skilled in debt management strategies and can negotiate with creditors on your behalf. They can help you develop a manageable repayment plan, potentially reducing interest rates or waiving fees.

Improved Money Management Skills

Through financial coaching, individuals learn effective money management skills. Coaches provide tools and strategies to help you budget, save, invest, and manage debt effectively. These skills not only solve current financial problems but also prevent future ones.

Reduced Financial Stress

Financial stress can have severe effects on mental and physical health. By helping you gain control of your finances, financial coaching and counseling can significantly reduce financial stress. Knowing your financial situation is under control can bring peace of mind and improve overall wellbeing.

Personalized Financial Plan

Financial coaching and counseling offer personalized financial plans tailored to your unique situation and goals. These plans take into account your income, expenses, debt, and financial goals, providing a roadmap to financial success.

Conclusion

In a world where financial decisions can make or break your future, financial coaching and counseling are invaluable services. They equip individuals with the necessary tools and knowledge to navigate the complex financial landscape and make sound financial decisions. Whether you're in debt, struggling to save, or just want to improve your financial literacy, consider seeking the help of a financial coach or counselor. Their expertise could be the key to unlocking a stress-free financial future.