Introduction

Financial literacy, or the understanding of how money works, is a vital life skill that many people often overlook. In today's fast-paced world, financial education plays a crucial role in shaping our lives, helping us make informed decisions about savings, investments, and overall money management. Without it, we are prone to making poor financial decisions that could have serious implications on our financial health.

The Importance of Financial Education

Financial education is the foundation of a secure financial future. It equips individuals with the knowledge and skills to manage money effectively, enabling them to navigate through life's financial challenges. Here are some reasons why financial education is important

1. Financial Independence

Financial education is the key to achieving financial independence. It empowers people to take control of their finances, make informed decisions regarding investments, and plan for their future. With financial literacy, individuals can build wealth, avoid debt, and achieve their financial goals.

2. Debt Management

Without a proper understanding of finances, it's easy to fall into a debt trap. Financial education teaches individuals about interest rates, the dangers of high-interest loans, and how to manage and pay off debts. Informed individuals can avoid excessive debt and maintain financial stability.

3. Better Decision Making

Financial education equips individuals with the knowledge to make sound financial decisions. From choosing the right insurance policy to investing in the stock market, financial literacy enables individuals to evaluate the risks and rewards involved, leading to better decision-making.

4. Planning for the Future

Whether it's planning for retirement, buying a house, or saving for a child's education, financial education helps individuals plan for their future. It teaches them about the importance of savings and investments, helping them secure their financial future.

5. Economic Stability

On a larger scale, financial education contributes to the economic stability of a nation. A financially literate population is more likely to make informed decisions, leading to a healthier economy.

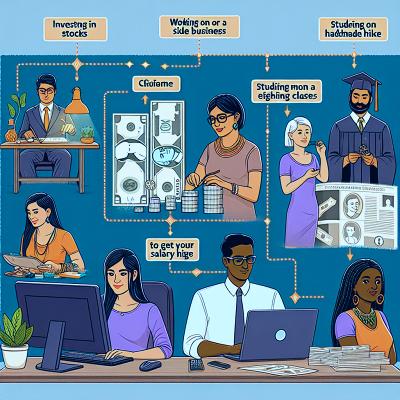

Improving Financial Education

Improving financial education should be a priority for both individuals and societies. Here are some ways to enhance financial literacy

1. Incorporate Financial Education into School Curriculum

Financial education should start at an early age. Incorporating it into school curricula can help children understand the value of money and the basics of saving, spending, and investing.

2. Make Use of Online Resources

There are numerous online resources available today that can help individuals improve their financial literacy. From online courses to blogs and podcasts, these resources can help individuals gain a better understanding of financial concepts.

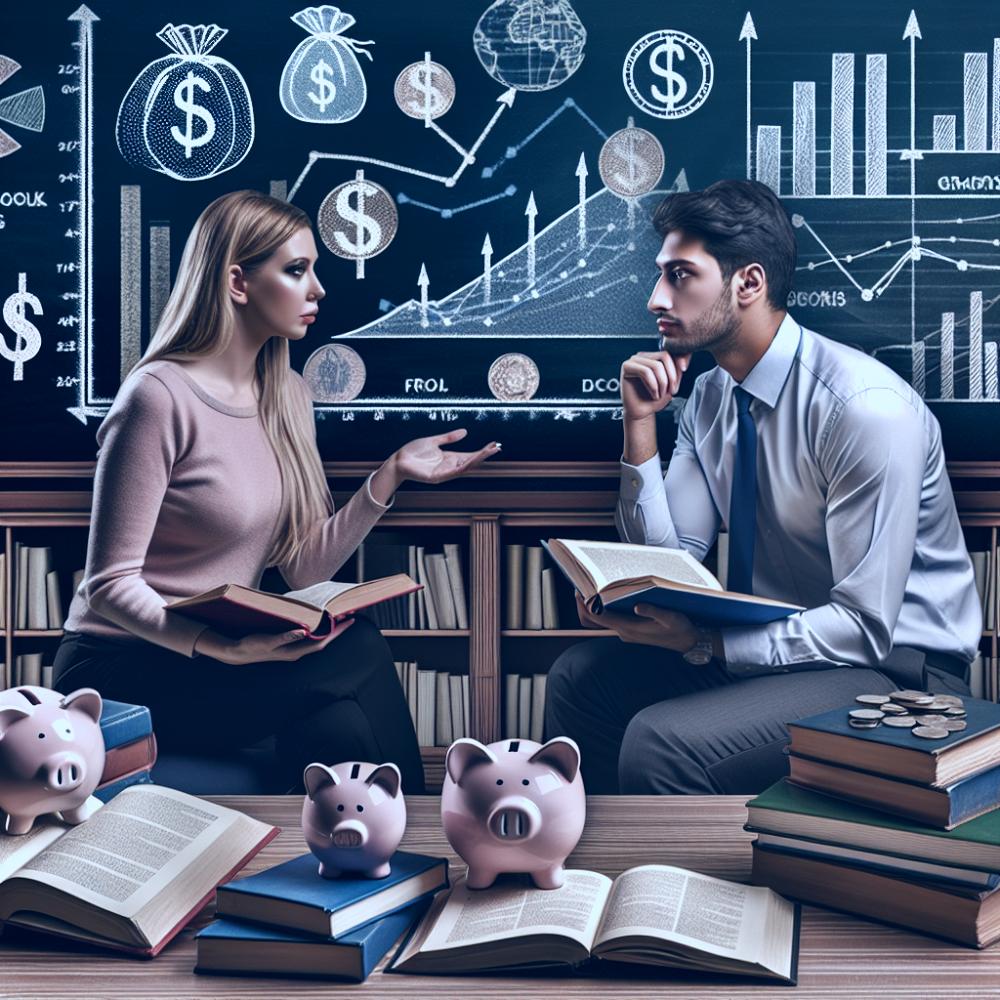

3. Consult with Financial Advisors

Financial advisors can provide personalized advice based on an individual's financial situation and goals. They can help individuals make informed decisions and plan for their financial future.

Conclusion

In conclusion, financial education is an essential life skill that everyone should possess. It empowers individuals to make informed decisions, achieve financial independence, and secure their financial future. Investing in financial education can lead to a financially stable and prosperous life. Keep in mind that it's never too late to start learning about finances. Remember, the journey to financial literacy starts with a single step.