Introduction

Freelancing can offer a wealth of opportunities, from the flexibility of setting your own schedule to the independence of working from anywhere. However, one area where many freelancers struggle is managing money. Unlike a traditional job, freelancing income can be inconsistent, making it difficult to budget, save, and plan for the future. Here's a comprehensive guide to help you navigate the complex waters of financial management as a freelancer.

Understand Your Income

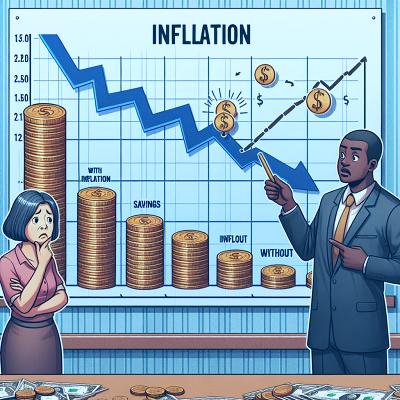

The first step in managing your money as a freelancer is to fully understand your income. Unlike traditional employees who receive a consistent paycheck, freelancers often have irregular income streams. One month you might earn a lot, and the next, you might earn very little.

To manage this, track your income over several months to get an average monthly income. Use this average to budget your monthly expenses. This will help you avoid overspending during months with higher income and under-spending during months with lower income.

Create a Budget

Budgeting is an essential tool for managing money, especially for freelancers. With a fluctuating income, it's vital to know where every dollar is going.

Start by listing your necessary expenses, such as rent, utilities, groceries, and insurance. Next, allocate funds for discretionary spending, like eating out or entertainment. Lastly, set aside money for savings and investments.

The key to successful budgeting is regularly reviewing and adjusting it based on your income and spending habits. There are many budgeting tools and apps available to help you keep track of your spending and savings.

Set Up an Emergency Fund

An emergency fund is a financial safety net that can cover unexpected expenses or income loss. For freelancers, who may experience periods of no work or delayed payments, having an emergency fund is especially important.

Financial experts recommend having three to six months' worth of living expenses in your emergency fund. Start by setting aside a small amount from each payment you receive until you reach your target. This fund should be easily accessible but separate from your regular checking account to avoid temptation.

Save for Taxes

Unlike traditional employees, freelancers are responsible for paying their own taxes, including income tax and self-employment tax. To avoid a large tax bill at the end of the year, it's recommended to set aside 25-30% of your income for taxes.

Consider opening a separate savings account for tax money and making regular deposits. Additionally, hire a tax professional who understands freelance taxes to help you take advantage of deductions and credits.

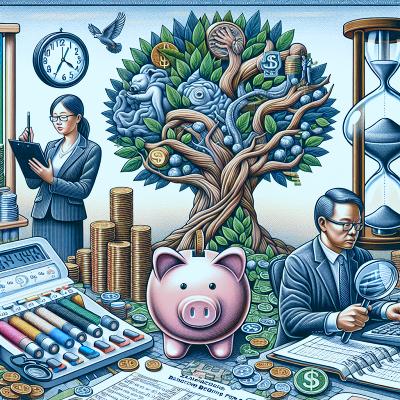

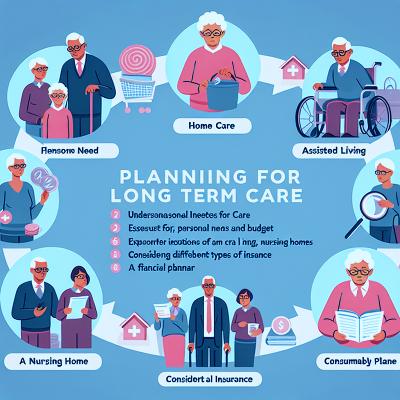

Plan for Retirement

Just because you're a freelancer doesn't mean you should neglect retirement savings. Consider setting up a Simplified Employee Pension (SEP) IRA or a solo 401(k) specifically designed for self-employed individuals. These accounts offer tax advantages that can help boost your retirement savings.

Consider Health Insurance

Freelancers typically don't have access to an employer-sponsored health insurance plan. Therefore, it's crucial to budget for health insurance to avoid significant financial risk in case of a health crisis. Consider options through the Health Insurance Marketplace, or look into organizations that offer group health plans for freelancers.

Invest in Professional Development

Investing in your skills and knowledge can lead to more lucrative freelance opportunities. Set aside a portion of your budget for courses, certifications, conferences, and other professional development activities.

Conclusion

While managing money as a freelancer can be challenging, it's far from impossible. By understanding your income, creating a budget, setting up an emergency fund, saving for taxes, planning for retirement, considering health insurance, and investing in professional development, you can achieve financial stability and success as a freelancer. Remember, the key to financial management is consistency and discipline. Stick to your budget, regularly review your finances, and make adjustments as necessary. With these strategies, you'll be on your way to a financially secure freelance career.