Introduction

In today's financial world, it is essential to diversify your portfolio. One of the most popular and effective methods of investment diversification is investing in bonds. But what exactly are bonds, and how do they work? This article will demystify the world of bonds, explaining their mechanisms, types, benefits, and risks.

What are Bonds?

A bond, in the simplest terms, is a loan made by an investor to a borrower. The borrowers are typically corporate or governmental entities. When you buy a bond, you're lending money to these organizations in exchange for periodic interest payments and the return of the bond's face value when it matures.

How do Bonds Work?

When an organization needs to raise money for various reasons, such as funding a new project or managing current debts, it issues bonds. The issuer sets the bond's face value, the interest rate (also known as the coupon rate), and the maturity date at this stage.

After issuance, these bonds can be bought by investors. The issuer promises to pay the bondholder interest at a fixed rate and repay the face value of the bond (the principal) when the bond matures.

The Different Types of Bonds

There are primarily three types of bonds - Treasury bonds, corporate bonds, and municipal bonds.

Treasury Bonds

These are issued by the national government and are considered the safest bonds to invest in because the government backs them. They have long maturity periods, usually over ten years.

Corporate Bonds

These are issued by companies to fund new projects or manage existing debts. They offer higher yields than government bonds but come with a higher risk level.

Municipal Bonds

These are issued by state or local governments or their agencies to finance public projects. The interest earned on these bonds is usually exempt from federal taxes and, in some cases, state and local taxes.

The Benefits of Investing in Bonds

Investing in bonds offers several benefits.

Regular Income

Bonds pay interest regularly, usually semi-annually, making them an excellent source of steady income.

Capital Preservation

Bonds are considered safer than stocks, making them ideal for conservative investors looking to preserve capital.

Diversification

Adding bonds to a portfolio of stocks can provide diversification, reducing risk.

Tax Exemptions

Some bonds, like municipal bonds, offer tax-free interest income.

Understanding the Risks

While bonds are generally considered safer than stocks, they are not risk-free.

Interest Rate Risk

When interest rates rise, bond prices fall. This inverse relationship can result in losses if you need to sell a bond before its maturity.

Credit Risk

There's always a risk that the issuer could default on their payments. This risk is higher with corporate bonds.

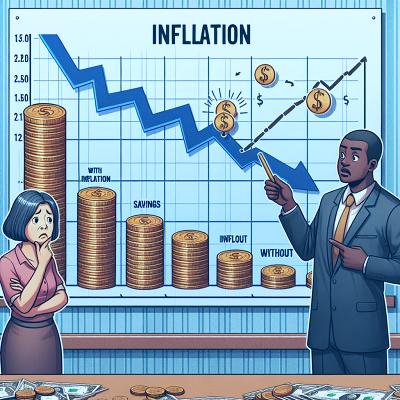

Inflation Risk

Over long periods, inflation can erode the purchasing power of a bond's fixed interest payments.

Conclusion

Bonds are a critical component of a well-balanced investment portfolio. They provide steady income, safety of principal, and portfolio diversification. However, like all investments, they come with risks that investors should understand. As always, it's best to consult with a financial advisor or conduct thorough research before making investment decisions.